This is a free monthly edition from Compounding Research. An email about one investment case on an undervalued company that makes you a smarter investor.

What if you could buy $1 of assets for just $0.36, but it’s in a volatile oil cycle, would you take the bet?1

Then you want to hear about Valaris, one of the world’s largest fleets of offshore oil drillers.

Source: Valaris (jackup oil drilling rig)

Stock deep dive: Valaris

Valaris may not be a forever hold or compounder stock, but it’s a perfect example of an opportunistic value investment.

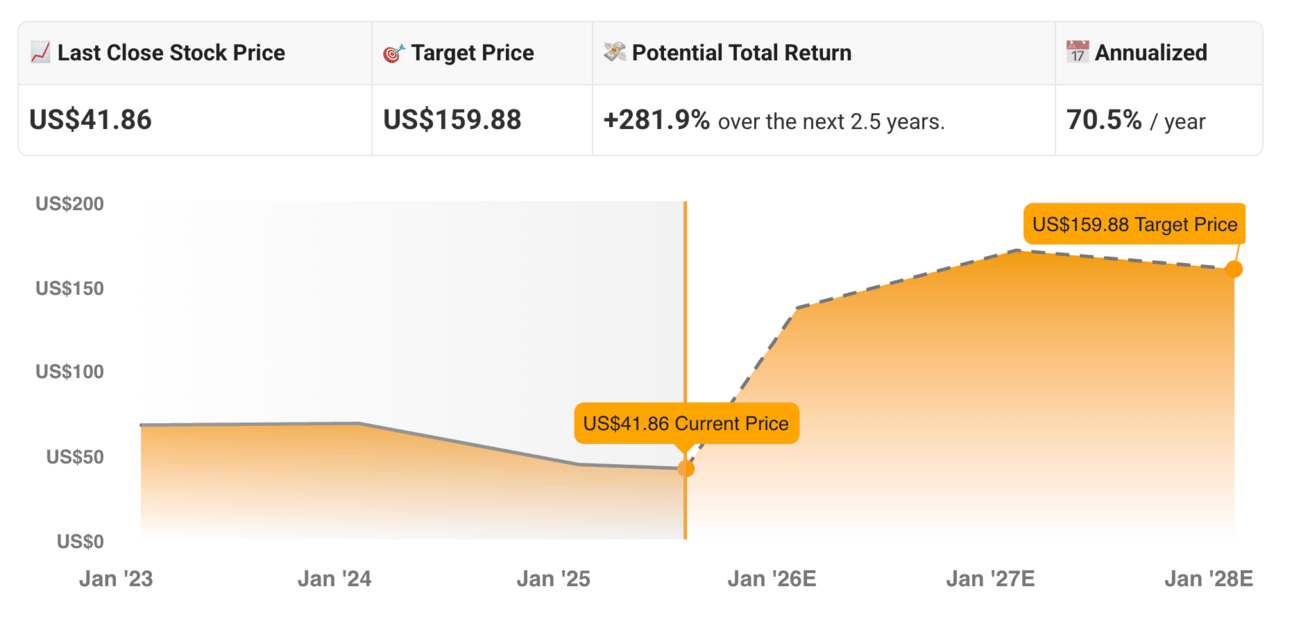

The stock is estimated to grow from $45 to its fair value of $159 in 1-2 years because of undervalued assets, rising oil demand, and guaranteed revenues.

That value investing opportunity also caught the eyes of billionaire Mohnish Pabrai, who bought $56 million of shares in Q1 20252.

And Mohnish only makes a handful of bets per year, usually in companies trading well below their asset value.

So, what does Valaris do, and why could the stock double or triple in 1-2 years?

Let’s dive into this investment case that saves you 15+ hours on researching the news, investor and analyst reports. So you can judge if it’s a great investment for you.

Source: Tikr (P/E Valuation Model)

What does Valaris do?

Yes, Valaris owns one of the largest fleets of offshore oil drilling rigs in the world. But it doesn’t extract or sell oil itself.

Instead, it rents out its 51 drilling rigs to energy giants like Shell, who pay up to $400,000 a day to drill deep beneath the ocean floor in search of oil and gas reserves.

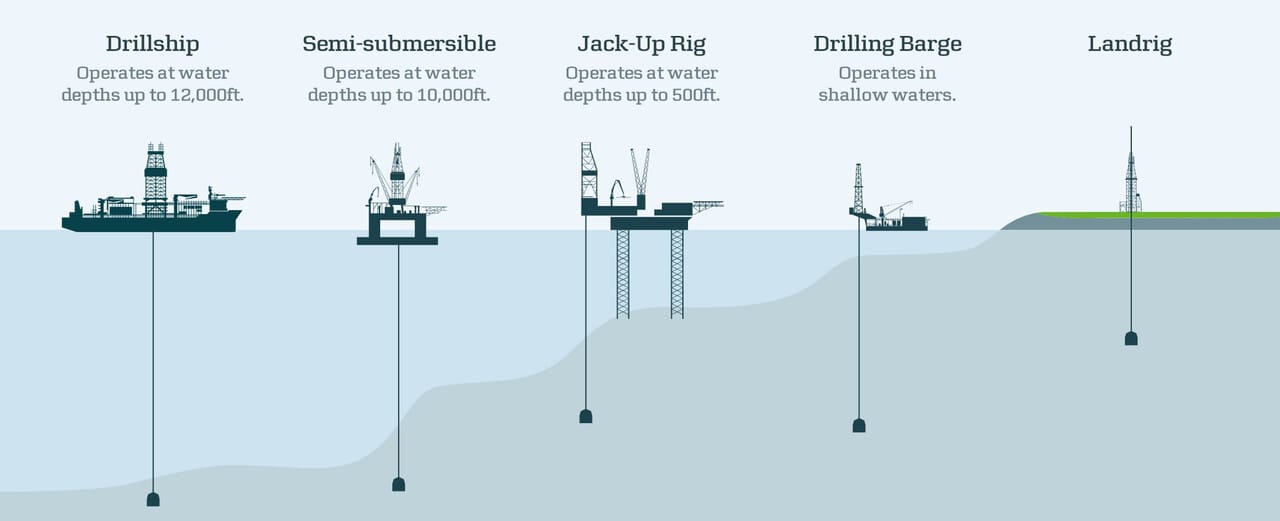

These drilling rigs include ultra-deepwater drillships, semisubmersibles, and jackups that operate in everything from shallow waters to the deepest parts of the ocean.

Once the oil is found, it’s pumped up and refined into fuel for cars, heating for homes, and everyday products like shampoo bottles.

Source: Drill Techniques (different types of oil drilling rigs)

Financial Evolution

(2021–2024)

Let’s take a look under the hood.

Valaris has been renting out offshore drilling rigs since 1975. But in 2020, it filed for bankruptcy after oil prices collapsed, and restructured to come with less debt.

Since then, Valaris has quietly rebuilt its financial engine. Revenue is climbing, margins are expanding, and the balance sheet seems more healthy.

Here’s the key breakdown:

What the numbers show:

Revenue more than doubled since 2021, a clear sign the offshore oil cycle is heating up again.

EBITDA margins are rising as more rigs work more days at better rates.

Net income turned positive in 2022 and jumped in 2024.

Free cash flow is still negative, but that’s due to upfront drilling rig reactivations.

Net debt is low. No red flags here for a capital-heavy business like this.

Valaris is no longer in survival mode, it’s building for the next oil cycle. But the stock price doesn’t yet reflect that shift. That gap might be an opportunity for value investors.

Because here’s what most investors miss:

When Valaris went bankrupt in 2020, it wiped out over $7.1 billion in debt, but kept the drilling rigs.

So investors are basically buying a $8B+ fleet… without paying for the debt that originally financed that fleet.

Or in Mohnish Pabrai’s words: “You get the assets, but you don’t carry the baggage.”

How management’s outlook has evolved from crisis to confidence (2020-2025)

Valaris’ management outlook didn’t change overnight. It climbed out of bankruptcy, one year at a time.

Here’s how management’s tone shifted from “hang on” to “we’ve got this”:

2020 (Bankruptcy & restructuring): We’re cutting debt and conserving cash to stay alive.

2021 (Post-bankruptcy stabilization): We’ve streamlined the fleet and are cautiously optimistic.

2022 (Recovery begins): Utilization is picking up and the contracting environment is improving.

2023 (Offshore oil cycle gains traction): Dayrates are rising fast and we’re reactivating more rigs.

2024 (Growth mode): We’re locked into multi-year contracts and well-positioned for the upcycle.

Q1 2025 (Inflection point): Free cash flow is coming in 2026, and this cycle still has room to run.

As you can see, the tone didn’t shift overnight. It moved with every rig reactivated, every contract signed, and every earnings beat.

What they said in the Q1 2025 call

Management confirmed it again: the offshore cycle is strong, and they’ve got the contracts to prove it.

They expect free cash flow to turn positive in 2026, once the big upfront investments in rig reactivations slow down and those rigs start pulling in cash.

It’s like renting out a house, the money goes out first, but once tenants move in, it pays back steadily.

Q1 2025 in numbers

Here’s what the latest quarter looked like:

Revenue: $618 million

Adjusted EBITDA: $162 million

Net income: $108 million

Operating cash flow: $118 million

CapEx: $86 million (mostly tied to rig reactivations)

Backlog: $3.4 billion

In other words: rigs are coming back online, contracts are locked in, and the cash engine is warming up.

What that means for investors: By 2026, the heavy investment phase should be behind them. At that point, more cash comes in than it goes out (positive Free Cash Flow).

Who Are Valaris’ Main Competitors?

Valaris operates in a niche but fiercely competitive market: offshore oil drilling.

Here’s a quick look at the companies they go head-to-head with:

What sets Valaris apart?

Fleet Size: With 51 rigs, Valaris operates the largest fleet in the sector.

Asset Quality: Many of its rigs are newer or recently reactivated, giving it a tech and reliability edge.

Contract Visibility: Its backlog is among the highest — ~$3.4B in Q1 2025.

Lean Cost Structure: Since restructuring, Valaris runs with lower debt and a cleaner balance sheet than most peers.

In a tight rig market, the winners are the ones who can say “yes” when oil companies call to become a customer.

Valaris has more high-quality rigs ready to go than most of its competitors, which means it can pick up more contracts, faster.

And more contracts = more cash flow, especially now that dayrates are climbing.

Why could Valaris grow?

To know what Valaris could be worth, we need to understand what will drive its profits.

Let’s have a look at why the stock could appreciate in the next 1–3 years. It won’t compound forever, but enough to deliver strong upside for patient investors.

Here are 7 key factors that could increase its profits, driving the stock higher:

#1 Pricing power: Rising day rates

Valaris mentions in its Fleet Status Reports that in 2021, it rented some of its drilling rigs to energy companies for $195,000/day.

Now, they have customer contracts that pay much higher day rates of $432,000/day in 2026 and even $506,000/day in 20273.

Higher day rates results in

→ more profit per rig

→ more earnings per share

→ potential stock price increase

Source: Compounding Research (based on data in the Valaris Annual Report 2021-2022-2023-2024)

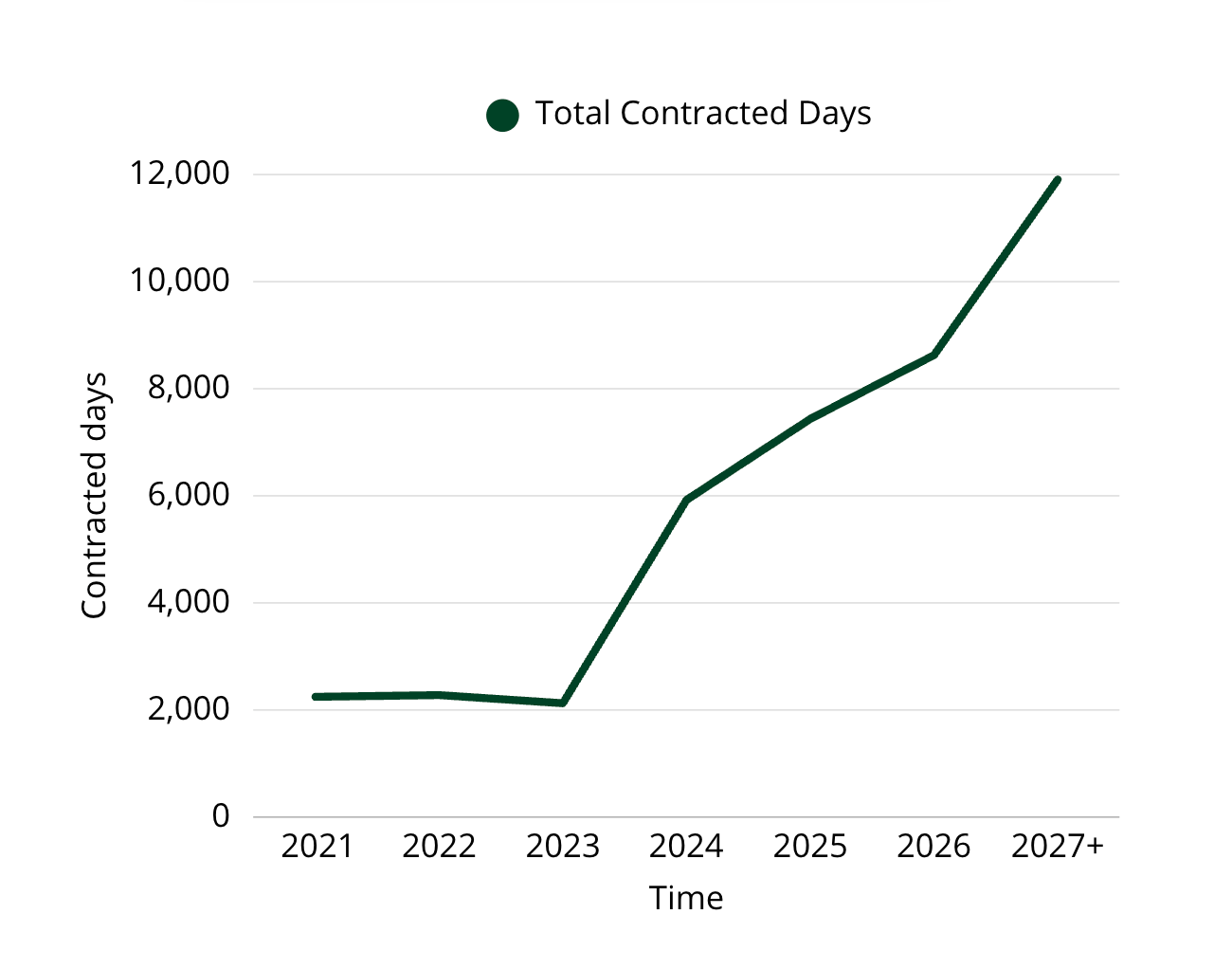

#2 Utilization: Rising contracted days

Valaris isn’t just charging more per day, they are booked for more days than ever.

In 2021, they had just 2,247 contracted rig days. By 2026, that number jumps to 8,627 days, and reaches 11,906 days in 2027.

This matters because Valaris owns over 50 rigs.

More rigs working more of the time means

→ more revenue and profit

→ higher investor confidence and demand

→ potential stock price increase

Source: Compounding Research (based on data of Valaris Annual Report 2021-2022-2023-2024)

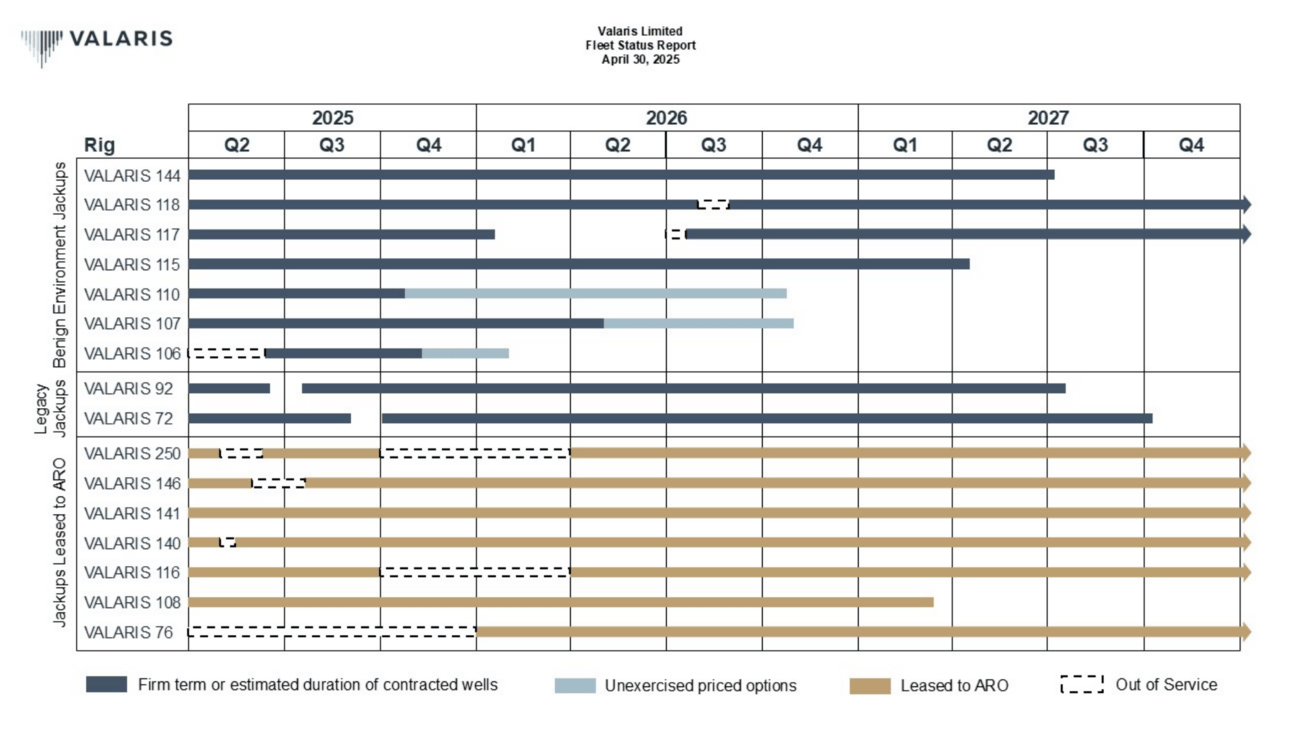

#3 Certainty: Locked-in customer contracts

We’ve seen that Valaris will (1) earn more per day and (2) for longer. Now here’s the third great thing: they have already locked in those rates and days in customer contracts for the next 2 years.

As you can see in the chart below, most of Valaris’ rigs are fully booked into 2026 and even 2027.

This means that the future revenue and profit aren’t just “possible”, they are already contracted.

Locked-in contracts means

→ guaranteed revenue and profit

→ higher investor confidence and demand

→ potential stock price increase

Source: Compounding Research (based on data in the Valaris Fleet Status Report 2025)

#4 Demand: Growing oil demand

Most people assume wind and solar energy are replacing oil, but we’re not there yet.

Global oil demand is still rising. It’s expected to reach 108 million barrels per day by 2030, as you can see on the chart below4.

When oil demand goes up, energy companies drill more, especially offshore. That’s how Valaris and its competitors will receive more customer contracts.

Strong oil demand could turn into

→ more contracts, revenue and profit

→ higher investor confidence and demand

→ potential stock price increase

Source: Oxford Institute for Energy Studies

#5 Competitive advantage: Tight rig supply

Global rig supply has dropped by ~40% over the last decade. However, Valaris has one of the largest fleets in the industry, so it can take on more work than its competitors.

It would take peers years to catch up, as building a new rig takes 4-5 years and costs hundreds of millions.

Fewer competitors with available rigs means

→ more contracts, revenue and profit

→ higher investor confidence and demand

→ potential stock price increase

Source: Valaris Investor report 2023 (Fleet size per offshore drilling company)

#6 Undervaluation: Revaluation of assets

Valaris owns a fleet worth $8.8 billion, based on what similar rigs sold for. But it trades for just $3 billion in market cap.

In other words, buying the stock today is like paying $0.30 to get almost $1 worth of value.

That’s a huge gap.

The value of its fleet could be much higher when the market starts valuing them based on (1) what it would cost to build them today or (2) what similar rigs sold for recently.

That’s like owning a house on your books for $200,000, but the market value is actually $500,000.

A revaluation of assets could

→ higher investor confidence and demand

→ increase the stock price

Figure 1: Average market value of driling rigs

#7 Timing: Early in the offshore oil cycle

Offshore drilling is a cyclical business, and the data shows this cycle is still in its early stages. There are 3 similar signals from the peak of the supercycle of 2010-2014:

Signal 1: Rig utilization8

Back then: 88–94%

Today (2026–2027): 88–92%

Signal 2: Day rates8

Back then: $500K-$650K/day

Today (2026-2027): $432K-$506K/day

Signal 3: Global offshore fleet8

Back then: ≈936 rigs

Today (2026-2027): ≈560 rigs (fewer rigs available while demand for drilling is rising → Valaris can capture a larger part of the market)

Source: Statista

What is the valuation?

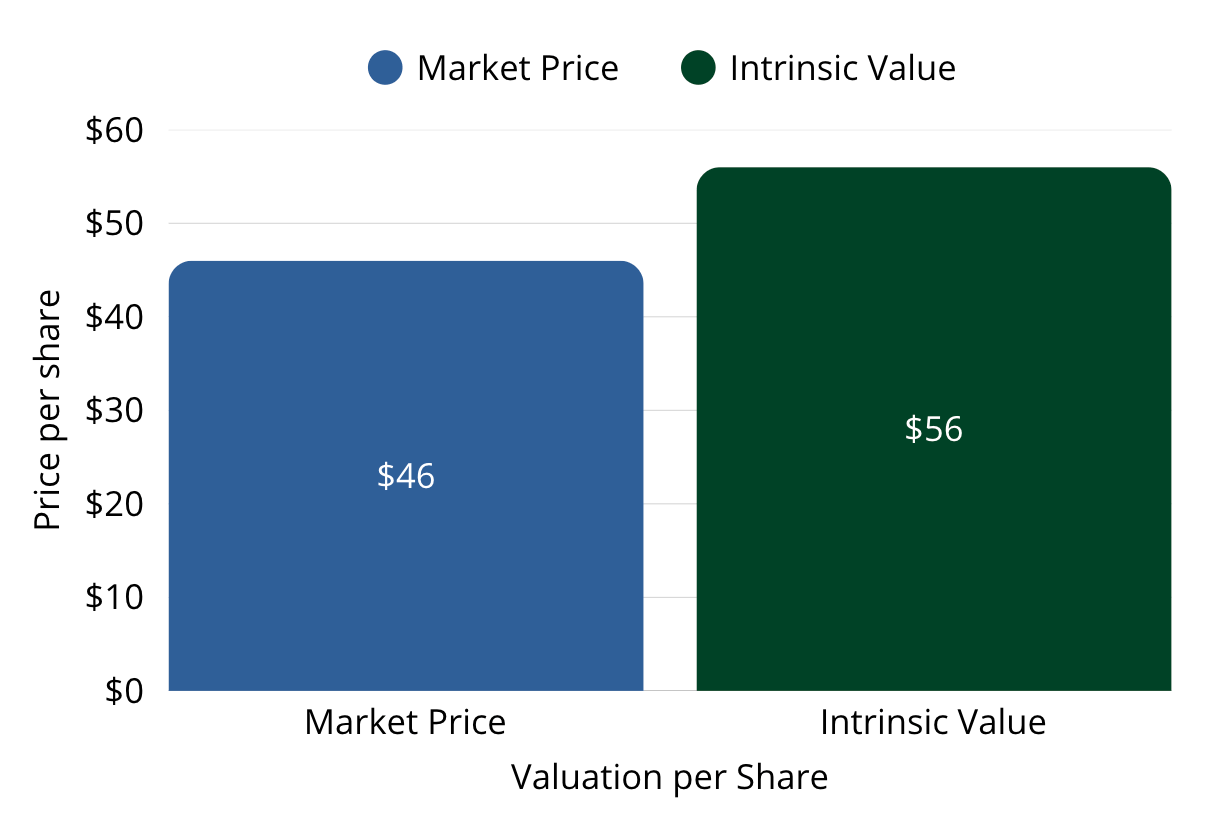

To know the valuation of Valaris, we need to look at (1) the current price, (2) what it’s actually worth (its intrinsic value), and (3) what it could be worth in the future.

1. What is the current price of Valaris?

Valaris is now trading at $45/share and has 71.07 million shares. Multiply those, and you get a market capitalization of $3.15 billion, which is the total value investors place on the shares of the company.

As value investors, the key question is: can we buy this business for less than it’s worth?

To answer that, we need to estimate its intrinsic value.

2. What is Valaris actually worth? (intrinsic value)

To figure out what Valaris is really worth today, its intrinsic value, we need two things:

How much profit (net income) the company makes (in this case: $253 million)

How much the market typically pays for $1 of profit in this industry

That second part is called the P/E ratio (Price-to-Earnings). It’s just a shortcut investors use to say: “I’m willing to pay X dollars for every $1 this company earns.”

In Valaris’ case, the recent average P/E is 15.81. This means investors are willing to pay $15 for every $1 of annual profit.

So if we multiply that by the company’s profit:

$253M net income × 15.81x P/E = $3.99 billion intrinsic value6

That’s what the whole company would be worth if the market valued it fairly based on its earnings.

To get the value per share, we divide the $3.99B intrinsic value by the number of shares:

$3.99 billion intrinsic value / 71.07 million shares = $56/share intrinsic value

Now compare that to today’s share price: $45/share.

Source: Compounding Research

That means the stock is trading at a discount. You’re buying a share for $45, which is actually worth $56.

That discount is called your Margin of Safety. It gives you a buffer if the company earns less or grows slower than expected.

Even if the stock only recovers partway, say, to $49 instead of $56, you still make money because you bought in cheap at $45.

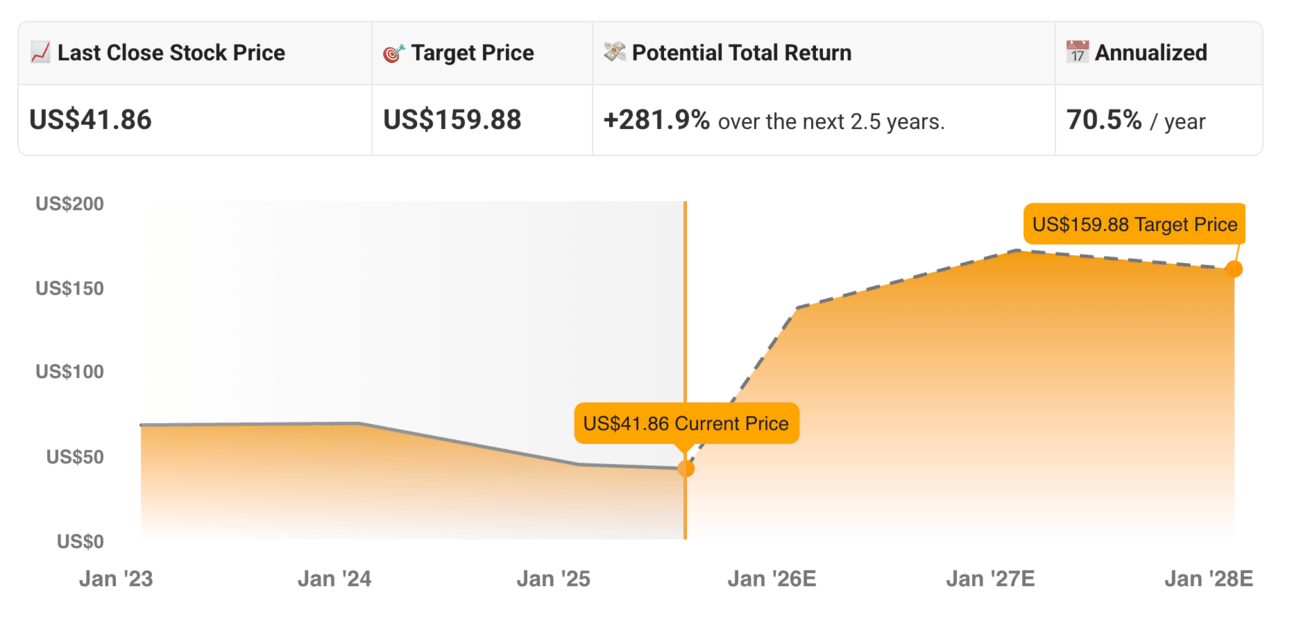

3. What could Valaris be worth in the future?

To estimate what Valaris might be worth in a few years, we can use the P/E Valuation Model on Tikr, based on three forward-looking assumptions:

1. Revenue growth: 30% per year

(2024 was 32%)

2. Operating margin: 15%

(2024 was 14.9%)

3. P/E multiple: 20x

(3-year average is 20.7x)

If Valaris performs like in 2024, with 30% revenue growth and a 15% margin, and trades at its 3-year average 20x P/E, the stock could reach an estimated fair value of $159/share in 2.5 years7.

Source: Tikr (P/E Valuation Model)

This is a conservative estimate, since the (already locked-in) day rates of 2026 and 2027 will be higher than in 2024.

And this is the core of value investing. Buying a company for less than it’s worth, and having the patience to wait until the market catches up and the stock price rises.

What are the risks?

While the upside case is compelling, this is not without serious risk. Let’s be clear on the four biggest potential downsides:

#1 Cyclical downturn

Offshore drilling is tied to oil prices, and oil prices are volatile.

Look at historical oil price data, and you see that oil and offshore drilling are cyclical industries. Demand rises when the global economy grows and oil prices are high.

But when oil prices drop, due to oversupply, a recession, or geopolitical tensions, energy companies pull back on spending.

A cyclical downturn is a real risk, even for undervalued companies. Because offshore drilling contracts get cancelled or delayed.

Fewer contracts could lead to

→ fewer revenue and profit

→ potential stock price decrease

#2 Asset revaluation risk

The estimated $8.8 billion fleet value of Valaris is based on recent transactions, in other words, what similar rigs were sold for in today’s strong market.

Just like real estate or used cars, the market value of rigs can go up or down, depending on supply, demand, interest rates, and investor appetite.

And since much of the “upside” in this investment case comes from the idea that Valaris is undervalued based on the resale value of its assets, a revaluation downward would shrink that gap.

In other words, if rigs are worth less than we thought, the stock might not be as cheap as it looks.

If drilling rig values drop

→ asset-based upside shrinks

→ investor confidence weakens

→ potential stock price decrease

#3 Execution risk

Valaris is spending hundreds of millions to reactivate and upgrade idle rigs. These investments are necessary to prepare for new contracts, but they’re not without risk.

If those rigs face delays, technical problems, or aren’t deployed on time, that money won’t generate the expected return.

In other words, Valaris could spend heavily upfront, but see little or no revenue if things don’t go smoothly, or if contracts fall through.

This would not only hurt cash flow but also reduce investor confidence in management execution.

If rig reactivations are delayed or underperform

→ cash flow weakens

→ growth expectations fall

→ potential stock price decrease

#4 Geopolitical or policy shocks

The price of oil reacts to everything from wars and government policies to global climate goals.

A sudden shift in regulation, like carbon taxes, or faster adoption of renewables, can pull oil demand down fast.

And when that happens, offshore drilling is often hit first. Why? Because it’s much more expensive to run a rig in the middle of the ocean than to drill a well on land, and it takes much longer to pause or restart.

That’s why even if Valaris is well-positioned today, we have to ask: what happens if the world changes faster than expected?

If policy or global events reduce oil demand

→ fewer offshore contracts get signed

→ long-term growth story weakens

→ potential stock price decrease

The investment memo

INVESTMENT TYPE

Valaris is an opportunistic value investment. It’s not a long-term hold or compounder, but a short-to-midterm bet on a mispriced asset in a rising oil cycle.

The combination of higher day rates, deeply undervalued rigs, and early-stage oil cycle recovery could drive a 2–3x return. But if oil prices fall or demand weakens, both earnings and valuation could drop.

VALUATION

Price today: $45/share

Intrinsic value: $56/share (based on current earnings)

Upside potential: $159 (based on future earnings)

Margin of Safety: ~24%

GROWTH OPPORTUNITIES

#1 Pricing power: Day rates are climbing past $500K/day (like at the peak of the previous cycle in 2010-2014)

#2 Utilization: More rigs working more days than ever

#3 Certainty: $4.2B in locked-in customer contracts

#4 Demand: Global oil demand keeps rising

#5 Competitive advantage: Fewer competitive rigs = more customers for Valaris

#6 Undervaluation: $8.8B fleet trading at a $3B market cap

#7 Timing: We’re still early in the offshore oil upcycle

RISKS

⚠️ Cyclical downturn: Oil demand and day rates are cyclical

⚠️ Revaluation risk The $8.8B fleet value is based on recent sales, this can change

⚠️ Execution risk: Delays could happen when reactivating rigs

⚠️ Geopolitics & policy: Oil is sensitive to politics and regulations

Thanks for reading to the end. I really hope this research report was useful to you. I put a lot of effort into it, and truly enjoyed it.

If you want access to more investment cases like this, please subscribe and send it to your investor friend who also loves to find hidden gems.

Sources:

Valaris’ estimated fleet value based on recent market transactions of drilling rigs: $8.8B (see figure 1). Current market cap: ~$3.15B. $3.15B divded by $8.8B = ~$0.36.

TIKR.com, Valaris Company Profile (Q1 2025 trailing data)

Disclaimer

The content published in Compounding Research is for informational and educational purposes only. It does not constitute financial, investment, legal, or tax advice, nor is it a recommendation to buy or sell any securities. All opinions are solely those of the author and are subject to change without notice. You should not rely on this content as a substitute for your own independent research or for professional advice tailored to your individual situation.

The author currently holds a long position in Valaris. This personal investment may influence the views expressed in this publication. Always do your own research before making any investment decisions.

The author and publisher of Compounding Research are not registered investment advisors, brokers, or dealers. Any investments discussed may carry a high level of risk and may not be suitable for all investors. By reading this publication, you agree not to hold the author or publisher liable for any decisions or actions taken based on the content provided. Always consult a qualified financial advisor before making investment decisions.